A breakdown of HBO's Money Electric: The Bitcoin Mystery "documentary" and how they got it wrong. Plus, a look at some challenges facing Bitcoin miners and the IMF talking tough.

Links:

Affiliate LINKS:

- 🇺🇸 Buy Sats on River - The best way to stack in the US

- 🇨🇦 The Bitcoin Well - An amazing automatic self-custody Bitcoin platform

- ⚡ The Bitcoin Company - Spending your Bitcoin Via Lightning

- 🏦 Fold Card - Pay bills Stack Sats

- 💵 SALT Lending - Get access to your BTC Value w/out Selling

Links:

- Is Bitcoin Inventor Satoshi Nakamoto Actually Peter Todd?

- Blockchain's Role in Mitigating Illicit Finance

- U.S. to sell Silk Road Bitcoin: 69,370 BTC to enter market

- FBI doxxed their wallets

- IMF: El Salvador Should Narrow The Bitcoin Law Reach To Access Funds

- Book: Hidden Repression: How the IMF and World Bank Sell Exploitation as Development by Alex Gladstein

- Bitcoin, The IMF, and El Salvador - YouTube

- Visa - Visa Introduces the Visa Tokenized Asset Platform

- Visa Launches Platform to Help Banks Issue Stablecoins Globally - Bloomberg

- Jack Mallers on X: "Einstein discovered E=mc², he didn't "invent" it. Satoshi discovered Bitcoin, he didn't "invent" it.

- Bitcoin was 40 years of work

[00:00:00]

Unknown:

Music. Welcome to This Week in Bitcoin, episode 30. My name is Chris. Thank you for joining me. I might be a little salty this week, so I apologize ahead of time. I don't know. I just think I'd wager that Bitcoin is one of the most significant technology innovations of our lifetime and beyond our lifetimes. And the people, the artists, the communicators that could help spread the word to a new audience, to people that don't understand it, always seem to get lost on who is Satoshi Nakamoto. And that happened again this week. Money Electric, the Bitcoin mystery, created by Colin Hoback, which he's also known for his documentary on QAnon, which, by the way, we'll get into this, but it's ironic that the creator of a film going after conspiracy people and QAnon is now employing the same exact kind of conspiracy by reasoning and coincidence type thinking to make this connection to who he believes Satoshi Nakamoto is.

Now, I wish people would just stop asking this. I really do. I think we should just seriously let this be. It's quite literally better for everyone. But the media won't stop. And they just get almost feverish about it. And as soon as the news about this documentary came out, they went into overdrive speculating who it could be, including speculating about the wrong people entirely that wasn't the conclusion of the movie. Today, everyone is talking about a new HBO documentary called Money Electric, the Bitcoin mystery. It launches today and it claims to unveil the identity of Satoshi Nakamoto.

Now, the documentary is directed by filmmaker Colin Hoback, who made a name for himself, unmasking the leader of the QAnon conspiracy theory. And while past efforts by investigative journalists have failed to find the true identity of Satoshi, the Internet is going wild. Hoback's cracked it, though. Nobody else has figured it out. Hoback has cracked it. And we'll get into his evidence. I've watched it, so you don't have to. It feels like it's six hours long. It's a topic I am extremely interested in, and it felt tedious to me. So I watched it. I'll pull a few clips that I think you need to know just so that way you know the context of it and the conclusions, and we can talk about it.

But I want to go back to my original point before we get there. This has led for at least a week now of speculation of who the big reveal might be and then doing these exposés on all of these individuals who didn't ask for the attention in the first place. Everyone is on the edge of their seats waiting to see who's going to be named as the creator of Bitcoin. You've probably heard a ton of theories of who Satoshi Nakamoto could be. Some saying it could be the CIA, while others say Hal Finney, Nick Szabo, even Elon Musk has made the list. But today on this show, I want to explore another name, Len Sassaman.

So who is he and why are so many convinced that he could be the mastermind behind Bitcoin? Let's get into it. Let's not, because he wasn't the conclusion of the documentary, if you can call it that. But it didn't lead to it just I mean, it led to everybody speculating for a week long. So I have really mixed feelings on this. Every now and then there's a couple of good bits of info that I wouldn't mind friends and family to understand. But there's also just lots of like low key accusations and implications that are kind of really in there just to make the document, the documentary, whatever the movie, the series to feel more compelling.

But it's people's lives that are kind of getting screwed with here. So, I mean, if I wasn't watching it for the pod, I probably would have just fast forwarded through some of this. The creator Hoback got into Bitcoin at least a little bit in 2017, played around with mining, but never really seemed to have much success, at least from his claims. And, you know, this is it's it comes on the HBO network. So, of course, starts with the big HBO stinger, you know, get ready, get ready. And kind of cleverly so, at the very beginning of the series, they try to hook you with the haters.

So the documentary just brings receipt after receipt after receipt of folks that said Bitcoin was dead or a scam. This is the opening right here. So every day, you know, you have nonstop Bitcoin. Who cares about Bitcoin? Jamie Dimon. 2010. I could care less what Bitcoin trades for, how it trades, why it trades, who trades it. If you're stupid enough to buy it, you'll pay the price for it one day. 2011. Forbes says it's the end of Bitcoin. Bitcoin seems like a scam. Magical internet money. It has no intrinsic value. 2013. Bitcoin is worthless. What makes it valuable? Totally BS. Bitcoin's a dead end.

It's a combination of a bubble, a pond scheme, and an economic disaster. Whatever it's doing, it's not money. Whatever Bitcoin is. Money. Bitcoin is simply going to implode before you know it. Today we're having a funeral for Bitcoin. 2021. Despite all the doomsday prophecies, just 15 years after launch, Bitcoin had become the 10th most valuable asset in the world, outperforming Wall Street by a massive margin. One of the biggest unanswered questions surrounding Bitcoin is who invented it? When you ask about the creator, Who created this? We have no idea. There's these things called nerds.

And in 2008, one of them made up Bitcoin out of thin air using the fake name Satoshi Nakamoto. Satoshi Nakamoto. Satoshi Nakamoto. Which I think are the Japanese words for monopoly money. So what Hoback tries to do is try to frame this as the Internet's biggest mystery. They'd be like king of the world. Who is Satoshi Nakamoto? Who do you think he really is? Simply put, Satoshi's identity has remained the greatest mystery of the internet age. No one knows who they are, even though a lot of people have tried to figure this out. Tonight's plan?

To reveal the identity of Satoshi Nakamoto, creator of Bitcoin. Is he no longer here? Is he amongst us? So then pretty quickly, the documentary moves into some of the original people that were around when Satoshi was around. It brings in a couple of OGs that have been in the space for a while, like Samson Mao and others. I reached out. Hello, we're going on a helicopter. Samson worked for a company that was trying to expand Bitcoin's reach around the globe. He considered himself a kind of diplomatic ambassador for Bitcoin. And the president was treating him like one.

President Pichelli, this is in the context of El Salvador. Samson was busy trying to convince Mexico's third richest man. And also Mexico. Known as Uncle Richie, to use his power plant to mine Bitcoin. Because, you know, who wants to just be third richest? He's trying to convince me that Bitcoin mining is a good business. It is a good business. It is a good business. But I'm not sure. We'll talk. Maybe Bitcoin mining is better business. Like myself, investors also had questions when it came to Satoshi, Bitcoin's anonymous creator.

It was the elephant in the helicopter, so to speak. There's this history of Satoshi Nakamoto. So we kind of continue to build up the mystery and the documentary fairly quickly eliminates Samson Mao as likely the, you know, the creator of Bitcoin. But it does touch on something here that may give us a little bit of insight into why Satoshi wanted to remain anonymous. There was an e-gold scandal just around the creation time of Bitcoin. The documentary touches on that. I remember before Bitcoin, there was something called e-gold. Yeah. And they were shut down by the Fed.

Just before the launch of Bitcoin, there was a digital currency backed by actual gold, which was reportedly processing $2 billion in transactions every year. E-gold is a currency that's currently pretty popularized with a lot of online users. They promised that e-gold would be here this year, next year, a thousand years from now. But it seems the U.S. government didn't give a shit what their website said. They arrested its creator and shut it down. The takeaway, if you're going to create a digital currency that will compete with the U.S. dollar, you might want to be really careful about letting people know who you are.

And because Satoshi disappeared and never cashed out, I figured maybe their identity should stay a secret. After all, it's not like they had some master plan for Bitcoin to replace the U.S. dollar and render them the richest person on Earth. Right? That's the kind of implication I'm talking about. About like satoshi's motivation here was like some sort of four-dimensional chess where they figured out that if they could create this open source project one day it would replace the u.s dollar and then they would come back after 20 or 30 years of being in hiding and be like surprise i'm now a very old man and i'm unlocking my billions that just doesn't make sense and that is where samson now tries to argue that this isn't some sort of like long-term power play plan he He tries to kill that theory in the doc. Right?

Satoshi understood the game theory of it all. If Bitcoin was successful, they'd go after him. I mean, if all the nation states adopted him, there's an anonymous figure somewhere that controls the largest share of it. I don't think he would have created this gift for the world just to keep it as a threat over the future. He was more thinking for the good of humanity. Money is very broken. When you read some of Satoshi's posts, you get a sense that that was true. And also when you remember that he originally committed that news of the banks getting bailed out. That was also an indication of his motivation.

So we go pretty quickly from Samson Mao to introduce Adam back. And this also introduces the creative rationale to keep the drama going in this documentary. Samson's boss is a cryptographer named Adam Back, which jumped out at me because Adam Back has a pretty important connection to Satoshi. He was believed to be the first person Satoshi ever reached out to. People have pushed Adam to release the Satoshi emails that Satoshi sent to him. I will note that since this documentary was filmed, it was filmed in 2022 22, and 2023. In his lawsuit with Craig Wright, Attenbach did release the emails that are being talked about right here, his private emails with Satoshi, which he did not want to release because he never got Satoshi's permission.

But as the discovery process works in a court case, he had to release those emails. And the emails confirm everything Attenbach says in his interviews in this documentary. Be the first person Satoshi ever reached out to. People have pushed Atten to release the Satoshi emails that Satoshi sent to him. But Adam is a very upstanding guy. His line of thinking is, that is a private conversation. So he's never released those emails. I've seen them, and, you know, they're real. Adam's company is called Blockstream. They were largely behind this effort in El Salvador. And now they were looking to help more countries adopt Bitcoin, which brings Bitcoin closer to becoming the new global standard.

Which in turn could make Satoshi the richest person on Earth. Oh, there's the motivation, right? They're trying to get out like El Salvador and other nation states to adopt us. They become the richest people in the world. And what really happens is after the creator of this drama thing talks to Samson and Adam back, he really just starts tracking down anyone who had any kind of presence while Satoshi was around and kind of just starts making accusations if they were alive and involved when Satoshi was online. When adam moved to malta bitcoin was just getting started it had no value yet so perhaps it's just a coincidence that malta is considered a tax haven again that is that is slander essentially that's that's an implication that is ridiculous it is i mean could it be true i don't i don't even like who cares it's his own end of it's his private individual matter why even slip a comment at the end that, oh, maybe he lives in Malta to avoid taxes.

Maybe he's Satoshi Nakamoto after all. So perhaps it's just a coincidence that Malta is considered a tax haven. Gross. So how'd you end up in Malta? So in 2009, I was working for a startup. I was thinking as a remote worker, I would try something adventurous, find somewhere interesting to live. The cryptography behind Bitcoin is what makes it secure. It's the crypto in cryptocurrency. And cryptographers, they're like the math wizards who are skilled at making digital locks. And to create Bitcoin, Satoshi referenced ideas from a few of them. In particular, something that Adam Back had invented called Hashcash.

And he dreamed this up 12 years before the creation of Bitcoin. So this is actually a key point that the creator of this drama series gets wrong. He could be interpreting this entirely differently. And we're going to come back around to this. This is part of the evidence that these people are not Satoshi, but he misinterprets it as evidence that perhaps they are. I'll let this play out, and then we'll follow up on that later on. Were you the first person that Satoshi reached out to? I believe so, yeah. He just sent an email saying that he's about to publish a paper.

What would become Satoshi's famous white paper. And wanted to know the correct way to cite Hashcash. Did you ever release the emails that you had with Satoshi? No. Was that to protect privacy because they were private emails or what was the reason? Yeah, kind of convention. I mean, convention, so-called netiquette, which was a popular term back then, was that you would not post somebody's emails without permission. Nobody knows how to reach this guy at this point. So I kind of ask, you know. Seems like the right thing to do, to be honest with you, especially considering how much attention they did draw.

People parsed through them looking at every single character and letter. It's sad. The folks around Satoshi have been getting harassed for years now. Instead of this energy going into spreading more information about Bitcoin, it goes into trying to solve this mystery and create this drama around it. You get a taste of that when the creator tries to interview Greg Maxwell. People like Greg Maxwell, they were considered the taught leaders. Greg doesn't do interviews anymore, right? Getting him to come out of his... This is Peter Todd. Home is seemingly off the table with Greg writing to me, I'm pretty exhausted from years of harassment driven by conspiracy theories.

I feel like I've given enough. Yeah. And we've also heard the same from Hal Finney's wife, that it's been a burden on the family. They've had invaders. They've had all kinds of things happen because of these wild speculations. So we kind of just, everybody who's been around when Satoshi's around is suspicious. And we then take some tangents into altcoins and we take a tangent into the block size war, which was fine. But then after that, the whole series takes a pretty hard turn. It's been delayed by at least a decade, if not more, because of this block size limit that was imposed, and probably covert government agents helping it along.

It starts interviewing Roger Ver, who we've talked about before on this podcast, and if you're not familiar with him, I recommend you go find that episode because it will speak to his motivations. Yeah. So, I guess we'll just go... Peter Todd. We'll just kind of go through time. Sorry, what was that? I said Peter Todd for one. Roger thought Peter Todd was working for the government? What indication did you have that he was perhaps collaborating with the government? Now, this is a conspiracy theory that Roger has cooked up before as an explanation why the big blockers didn't win.

And it's copium. And now this creator, I guess, is taking Roger's copium as a possible trail to follow. The things he was advocating that should happen with Bitcoin were counterproductive to Bitcoin being usable as cash and usable as money. Prior to 2013, pretty much all of Peter Todd's history appears to be wiped from the internet. I finally found his personal website. After all this digging, you know, he was wiped from the internet, but I finally found his personal website. 2001. We're in high school when he was communicating with the cypherpunks. He used this exclusive tool that only documentary experts that do deep research know about called Archive.org.

He joked that in the event he becomes an evil dictator who takes over the world, he was screwed up from childhood. He was a kid at the time. His father was an economist, and his mother taught him about encryption. He says Peter Todd has said before that his mom taught him how RSA works. She's not necessarily teaching him about encryption. Well, Peter Todd might have worked for a company manufacturing gyroscopes for drones in the military. Being in the CIA obviously wasn't on his resume. Or whatever the fuck Canada's intelligence agency is called. But Roger brought up something suspicious.

Later, somebody leaked this email exchange from him, and that guy openly claimed that he was working for the U.S. government. Anybody who looks on Google and searches Peter Todd leaked emails will see... Back in 2013, there was this email thread that had been leaked between Peter Todd and a guy who called himself John Dillon. And in the emails, Peter Todd was conspiring with this other guy who was affiliated with state actors. How we know that exactly, I'm not quite sure. Maybe the guy claimed he was, John Dillon claimed he was, if anybody remembers and has that bit of history. Boost didn't remind me.

How we knew that John Dillon was communicating with Peter Todd and that John Dillon had a connection to an intelligence agency. I know this guy in the documentary says that he does, but when I look at these emails, they don't really look legitimate to And in the emails, Peter Todd was conspiring with this other guy who was affiliated with state actors. With John Dillon claiming. Is that something an intelligence official would say? Would they say that? And also their email address was at googleemail.com. And maybe Amir just wasn't aware of this at the time. If it looks like something's coming into existence that could replace the U.S.

Dollar as the world's reserve currency, the U.S. government and its three-letter agencies absolutely without any doubt will do whatever they can, including secretly and covertly disrupting projects like Bitcoin. If the government wanted to undermine Bitcoin or try to get close to Satoshi, how might they do it? A guy that openly said that he was working for a three-letter agency literally paid Peter Todd to implement what's called replace by fee. John Dillon offered a strangely small $500 reward for anyone who could design Replace by Fee. Strangely small $500 reward by today's standards, but this was 2013.

It's a young, relatively unsuccessful project, and Peter Todd's a kid. So is $500 that strange? Replace by Fee. John Dillon offered a strangely small $500 reward for anyone who could design Replace by Fee. It was essentially a bidding service. If you pay more, you can send your Bitcoin faster. Replace by Fee was an attempt to fix one of Bitcoin's design problems, something that Satoshi had speculated on just before disappearing from the forums. And Satoshi knew it would be a fair amount of work. So why would Peter Todd do it for 500 bucks? On the forums, John Dillon publicly prodded Peter Todd to write some code for once.

And so in 2013, about three years after Satoshi's disappearance, Peter Todd solves this design problem. I played that little part creating this replace-by-fee patch. Which the big blockers thought was a terrible idea. Which, of course, Roger Ver was one of. Because it could result in some really high fees just to send some Bitcoin. Man, it'd be awful if those miners... You know, it's so funny, because how are the miners supposed to make money If it just if the blocks are huge and they store tons of data and the fees are super low, how does that work out for the miners?

I just don't understand the logic there. And so, of course, they interpret this as some sort of sign that the CIA sabotaged Bitcoin. Which the big blockers thought was a terrible idea because it could result in some really high fees just to send some Bitcoin. Peter Todd, whether he's a government agent, he's absolutely a super smart guy. He's got to be the smartest guy in the room. He always wants to make sure he can prove that he's the smartest guy in the room. So is anyone in this audience working for government right now? Because if you are, I guess I'm one of the people handling negotiation with government.

Even the email exchange made Peter Todd look pretty damn smart. But after the leak, John Dillon disappeared for good. As far as I know, Peter Todd never denied any of that. I think that's pretty much accepted as fact at this point. I don't know what you consider fact or not, Roger. But what I consider fact is that they go on about how it was going to destroy the Bitcoin network. And here we are at pretty low fees right now in 2024. That's the reality of it. Look, go look at the fees right now. I just all of this like dooms like all this dooms, all this doom casting about Bitcoin being sabotaged when the network seems healthier than ever.

Miners are, you know, taking a beating right now. They could use fees to be higher. So we end up with a couple, and I do mean a couple, pieces of key evidence that eventually points to Peter Todd as Satoshi Nakamoto, according to the creator of this drama series. And I'll play a little bit of that for you. I went through everything I could find on Peter Todd, going back to his earliest messages on the Bitcoin talk forum. Now, Peter likes to suggest that he didn't really get involved with Bitcoin until 2014. That's when I sort of quit the day job, if you will. But he had registered all the way back in December of 2010.

Okay, that's not unusual for an open source project at all. You start participating for a couple of years, just a little bit, it ramps up over time. And then, man, if you're really lucky every now and then, you get to make it a full-time gig. That's not a suspicious thing. That's totally normal. ...with Bitcoin until... 2014, that's when I sort of quit the day job, if you will. But he had registered all the way back in December of 2010. The first thing he wrote was just asking for an invite to something. But the next post, a few days later, was super technical.

And then he doesn't post again until 2012. But it's that super technical post that made me rethink just about everything. Now, this super technical post is just a comment about transaction fees. It is not super technical. I'll read it verbatim. Of course, to be specific, the inputs and the outputs can't match exactly if the second transaction has a transaction fee. That's obvious. That's basic fee understanding. And he's responding and making a pandemic comment and reply to something Satoshi said, which Peter Todd's kind of famous for. Anybody that knows him or follows him knows like he often will be like, oh, you missed this bit, though. That's kind of his thing.

And it's just a reply in a PHP BB, the old the old Bitcoin talk form. It's just a reply in that thread. A couple of posts down. Of course, to be specific, the inputs and the outputs can't match exactly if the second transaction has a transaction fee. This is the super technical post that unlocks the discovery for the director creator here. Doesn't post again until 2012. But it's that super technical post that made me rethink just about everything. I was so taken aback, I called my editor immediately. So he sets up a dramatic camera shot where he's coming down the steps, holding a coffee in his phone, and he's already got his laptop at the bottom of the steps.

It's snowy, and he's going to be on a speaker call with his editor. And they needed, you know, they needed to film the big reveal because you have to show this bit. So this is him having a kind of planned conversation with his editor. So kind of embarrassed I missed this. So his first post is on December 7th, 2010. 10. But then three days later, he makes another post. Of course, to be specific, the inputs and outputs can't match exactly if the second transaction has a transaction fee. This is his editor speaking over the speakerphone. Seems like he's responding to something. Yeah. Yeah, that's, and the editor's first take is it seems like he's responding to something.

Because he is. He was just popping in the thread and pointing out a pandentic little observation. Oh, he's responding to Satoshi. He's replying to Satoshi, yeah. Yeah, like an hour and a half later. But read it closely. Is he responding, David? Or is he continuing a thought? That's it. That's the evidence. You know, if you look at it in a different way, and you agree to look at it in a different way, is it a reply? Or was it actually the same person using two different accounts? That's his case. His case is that Peter Todd had two accounts on the form, one as himself and one as Satoshi Nakamoto, and he went to go amend his post and he did it under the wrong account.

That's his primary evidence. Of course, why Satoshi wouldn't just go edit his post, his own post? Why make a reply further down in a form thread under a different account? I just, this is, this is, this is the key evidence and it's weak. It's weak. But, you know, it didn't help that Peter Todd constantly joked about being Satoshi, which, you know, this director kind of took seriously. Just so suspicious. I wanted Peter to explain how this was possible. He's talking about the forum post being so suspicious. Satoshi's last post was like one week after I signed up for Bitcoin Talk. Right.

And then you disappeared. Yeah, then I disappeared. He went to school. He went to school. And Satoshi disappeared at the same time. Yeah. I really should have paid more attention to Bitcoin early on, but, you know, I had other stuff to do. You corrected Satoshi, but it kind of looks more like you were continuing a thought of Satoshi. Well, Satoshi made a little brain fart on, like, how exactly transactions work, and I corrected him on that very boring thing. Why didn't you delete the 2010 post? Why would I? Yeah, so why would he delete it? It's such a weird question, unless the guy's making up a conspiracy.

I mean, because it just makes you look like you had these deep insights into Bitcoin at the time. Well, yeah, I'm Satoshi Nakamoto. No, it was just an understanding of how the transaction fees work. It was just simply understanding that that is going to have a transaction fee on it, so it won't be the same exact amount. I mean, it's sort of the last thing you'd expect Satoshi to say. Ah, but that's it. That's like the metal level, right? Because I know you would expect Satoshi Nakamoto to delete the post. You just said, why didn't Satoshi Nakamoto delete the post?

The post that was corrected? Yeah, yeah, the correction post, right? But then I did the next level of meta and then didn't delete the post to go throw off people like you. Peter sure remembered this post he'd made 13 years ago awfully well. Yeah. I don't know, you're fitting him like footage that's just going to be... Yeah, oh, it's going to be great. Peter Todd's strategy, his game theory to throw people off the trail, Oh, no, I am Satoshi. I'm Satoshi Nakamoto. It was so effective, I hadn't really considered him a suspect. It's because it's ridiculous until you are out of ideas and you need to put a conclusion on this drama series.

So his host just puts all his cards on the table. Here's what I think happened. Possibly. Possibly. Okay. I think that John Dillon was created so that you would have an excuse to make Replace by Fee. A concept which you had envisioned years earlier, but you needed some kind of cover in order to make. And you also needed some cover for that 2010 post. Because I was Satoshi? I mean, yeah. You know, you're very concerned about all the privacy stuff, so you reach out to your old buddy Adam back, you say, we need to do something about this, but we need to pay the devs. It's probably, you know, not great for the director here that Peter is just laughing at him as he says this stuff.

But you can't join Blockstream because it would look too suspicious. So you don't. I will admit, you're pretty creative. You come up with some crazy theories. It's ludicrous. But it's the sort of theory someone who spends their time as a documentary journalist would come up with. So yeah, yeah, I'll say of course I'm Satoshi and I'm Craig Wright. And yes, I was definitely covering that little bit about, you know, fees to go pretend to be Satoshi. Or not Satoshi, one or the other. Well, why make up the whole John Dillon thing? Well, like I said, I'm not John Dillon. Okay.

Sorry, I'm not John Dillon. I don't know who that is. I'll warn you, this is going to be very funny when you put this into the documentary and a bunch of Bitcoiners watch it. I don't think they would be very happy with this conclusion, because it's pretty controversial within the community at this point. No, I suspect a lot of them will be very happy if you go this route, because it's going to be like yet another example of journalists really missing the point in a way that's very funny. What is the point? The point is to make Bitcoin the global currency. And people like you being distracted by nonsense can potentially do good on that.

I'm kind of surprised they left that in, you know, because that's how I feel about it, too. And then after watching more than two hours of this thing, literally at the very last minute before the credits drop, a last bit of updated evidence is crammed in that tries to support the Peter Todd theory. A few months after confronting Peter, I came across this old chat log that someone probably shouldn't have recorded, where Peter says, I'm probably the world-leading expert on how to sacrifice your Bitcoins, and I've done exactly. Music.

Would in fact sacrifice the Bitcoins and destroy all access. He's talking about Satoshi's original stash. But this wasn't proof. It's Bitcoin. Don't trust, verify. And sometimes you can't verify. And if Peter Todd and his friends at Blockstream were in fact behind Bitcoin, would he remain an idealist? Or was he still holding onto the keys to the world's fortune. Just in case. There you go. That's it. With an accusation implication at the end to tie it all up, of course, and no real delivery of any new information in there at all. Kobach offers, you know, just two main pieces of evidence there.

One, that Peter Todd somehow was Satoshi and had dual logins on BitcoinTalk and accidentally replied to his own comment under the wrong login, which is just the more I even say it out loud, the more bonkers. And the other key bit of evidence, if you will, is a undated post by Peter Todd talking about how he's probably the world's leading expert on how to sacrifice your Bitcoins. But Hoback never spoke to any of the family or friends of Peter Todd or did any research to see what Peter was doing in 2008 or what his family said he was doing, which is when Bitcoin would have been under heavy development.

And, you know, it kind of you get this idea that Satoshi created this God code, but it's not really the case. It had quirks. It had issues. It wasn't perfect. It was inspired. It was brilliant, but it needed a lot of work. And it wasn't just all whole of creation. He didn't create everything that makes Bitcoin out of whole cloth. He brought things together. We're going to get more into that and and why I despise the obsession with this topic later in the show. But I feel like, you know, that's enough for now. We spent plenty of time on this and now you don't have to. I'll wrap it up with some further points later on.

Music. Well, a crypto information sharing and analysis center is reporting that cash continues to be the dominant means of criminal activity and that cryptocurrency transactions are minor. In fact, from what they can tell after analyzing different sources of data, only 0.34 percent of cryptocurrency transactions could be potentially linked to crime. A wealth of their data comes from the United Nations Office on Drugs and Crime, Chainalysis, some other, they say other reputable sources. But that's, you know, the top sources, the United Nations. That's where they're getting that data from.

And using their own information, that's what they determined. The report makes the case that for better or for worse, open blockchains, quote, aid in tracing illicit transactions, contrasting with the anonymity of cash transactions. That's in their own report. And there are their audience. I'll have a link to the report, but their audience is not URI. It is governments. It is departments. It is legalized. And I think this is great to see. You know, I think the narrative that Bitcoin is used for money laundering or illicit activity is silly. It's the dumbest money you could use for crime like that.

I mean, there's ways to do it, but you're still taking a risk and there's just better ways to commit crimes. I mean, honestly, cash, gold, diamonds, that seems way better, but I don't know. I just don't know. I'm not the expert on that, but it's good to actually see some data come out from using sources that, you know, the machinery, quote unquote, trusts. Speaking of the machine. The U.S. government is setting up to potentially sell 69,370 Bitcoin, which I believe is more than the German government sold earlier in summer. It's a pretty notable legal development because the Supreme Court of the United States declined to review an appeal of ownership of the 69,370 Bitcoin from Silk Road.

Oh, now a company named Battle Born Investments claimed in a California court that they had acquired the rights to the sea Silk Road bitcoins through a bankruptcy estate. But that California court said they lacked compelling evidence and they went to appeals that was held up. And now the Supreme Court's decision not to review that appeal means that Battle Born's legal pathways are basically done. They're out. They have nothing left. And so the U.S. government can now liquidate these Bitcoins. And you'll recall that the Fed around July and August moved about $2.6 billion worth of Bitcoin to Fed Coinbase wallets.

And the timing of all of this just seems really odd. I'd like to know what you think, too. So if you're listening in, boost in and tell me. Why now? I guess, were they just on the edge of their seats waiting for the Supreme Court decision? It just seems odd to impact any financial market, especially now that there's the ETFs, in the final days of an election. You know, this is the U.S. market. It's a U.S. election. It just seems, A, that seems odd. And why make this move now when one of the candidates seems to have plans for that stash? So wouldn't it be prudent to wait till January? And it's not just Trump.

Democrat Representative Roe Connan suggested the government retain these assets as a strategic reserve as well. I don't like it. But I also am so sick and tired of this branch hanging over the Bitcoin community, this widow maker. It was the same thing with the Mt. out Gox coins forever. And now here we are with the Silk Road coins again and the government stash again. Sick of it, you guys. I'll keep an eye on it, but it's one of those things that could definitely put a little bit of downward pressure, downward pressure on the price for a little bit, but it'd only be temporary.

But your October may be slightly delayed. Music. Well, I've been to the land of Bitcoin. I went to Adopting Bitcoin last year, had a great time in El Salvador. And so that's why I follow with some interest what's going on over there when. It comes to pressure from the IMF. The IMF has really made a stink about El Salvador adopting Bitcoin for years, since 2021. And that criticism does seem to be drifting a little bit less harsh, but they still don't want the people to have Bitcoin. They still don't like it. Even though Bichelli has made it clear he's going to continue, the IMF felt it necessary to come out in the last week.

Their representative came out. Her name is Julie Kozak. And she laid out what the IMF wants to see El Salvador adopt. And it's all about reducing Bitcoin for the people, reducing the scope of their Bitcoin plan. Stick with it. She's a bureaucrat. But I think learning and understanding the language is important. So, on El Salvador, IMF staff have an ongoing engagement with the Salvadorian authorities, and the objective is to reach agreement on a new IMF-supported program that would help with the macroeconomic stabilization and adjustment and also growth-enhancing reforms. Ongoing discussions are focused on policies to strengthen reforms that can be used to boost productivity and economic governance.

Addressing risks arising from Bitcoin is a key element of these discussions. And of course, the goal is for the fund to be in a position to support a credible and well-sequenced policy package that is designed by the authorities. With respect to the details on Bitcoin, what we have recommended is a narrowing of the scope of the Bitcoin law, strengthening the regulatory framework and oversight of the Bitcoin ecosystem, and limiting public sector exposure to Bitcoin. Yeah, we don't want the people to have exposure to Bitcoin. And like El Salvador has the means to regulate and monitor the Bitcoin network in the way she's implying. Right.

El Salvador plans to exclude new debt issuance in its 2020-25 budget. That's massive for them, which may reduce their reliance on IMF funds. The IMF works its way into these countries. I will link you to a book called The Hidden Repression, How the IMF and the World Bank Sell Exploitation as Development. It's a book by Alex Gladstein, and it really puts into perspective what the IMF is actually all about. Out as for el salvador since adopting bitcoin their gdp is up 10 10 now consider that the only thing holding up our gdp is the military industrial complex and government spending, they don't have that their murder rate since adopting bitcoin down by 95 and tourism is up 25 or sorry big difference tourism's up 95 in 2023 alone and i'll say this too having been there the The vibe is good. The people are happy.

I spent time at Bitcoin Beach, Azante, and I also spent time at San Salvador and a couple places in between. And everybody was extremely nice and happy. And I'm sure they're there, but I didn't see a single homeless person in San Salvador. I walk around my small little town here in Washington and there's homeless everywhere. So El Salvador is definitely going through a very positive change. And the IMF just is losing relevance when a company adopts a Bitcoin standard. And you can hear it in her voice. They're annoyed by the entire thing. It's too bad. And El Salvador hopes to issue those volcano bonds to perhaps, I guess, reduce reliance on the IMF.

I mean, we'll see. Mining is a tough industry. Let's talk about that. Publicly traded miners focused on expanding their hash rates in September. A lot of increases there. There's also been some significant liquidation of their Bitcoin holdings. I think the ETFs have been snapping up minor Bitcoin. In fact, miners collectively sold, get ready for this, 2,267.5 Bitcoin in September, which is up from 1,400 in August. There was Cypher mining leading the pack with 923 Bitcoin sold. And public miners like Core Scientific and Hut8 advanced their AI initiatives. With Core Scientific planning for AI data centers in three different locations.

This has been a trend that I've been kind of low-key noticing all of this year. Is that some of the bigger Bitcoin mining operations are switching some of their future capacity from Bitcoin to AI. Like I don't see them taking Bitcoin capacity offline, but like the capacity they were planning to give to Bitcoin, they're giving to AI workloads and they're making a lot of money. So why? Well, Bitcoin mining is a very tough business and comparatively AI is an easy business, especially if you're just selling the compute. But I think there's a bigger trend at play here. I think the reality is Bitcoin miners have figured out how to do power in these situations.

And these AI machines are so power hungry. Standard data centers are just totally flopping on this, and they're getting a really bad rap in the press. And it seems like big tech solution like Microsoft and Amazon and Apple, they're going to spin up old nuke plants and try to get new nuke plants built. That's going to take like a decade, though, in some cases. And they need it now, right? They've got to keep this AI train moving forward, baby. You can't stop this thing. Is not in service. Please make a note of it. So the Bitcoin miners, they know how to do compute, they know how to do cooling, and they know how to take advantage of the power nobody wants.

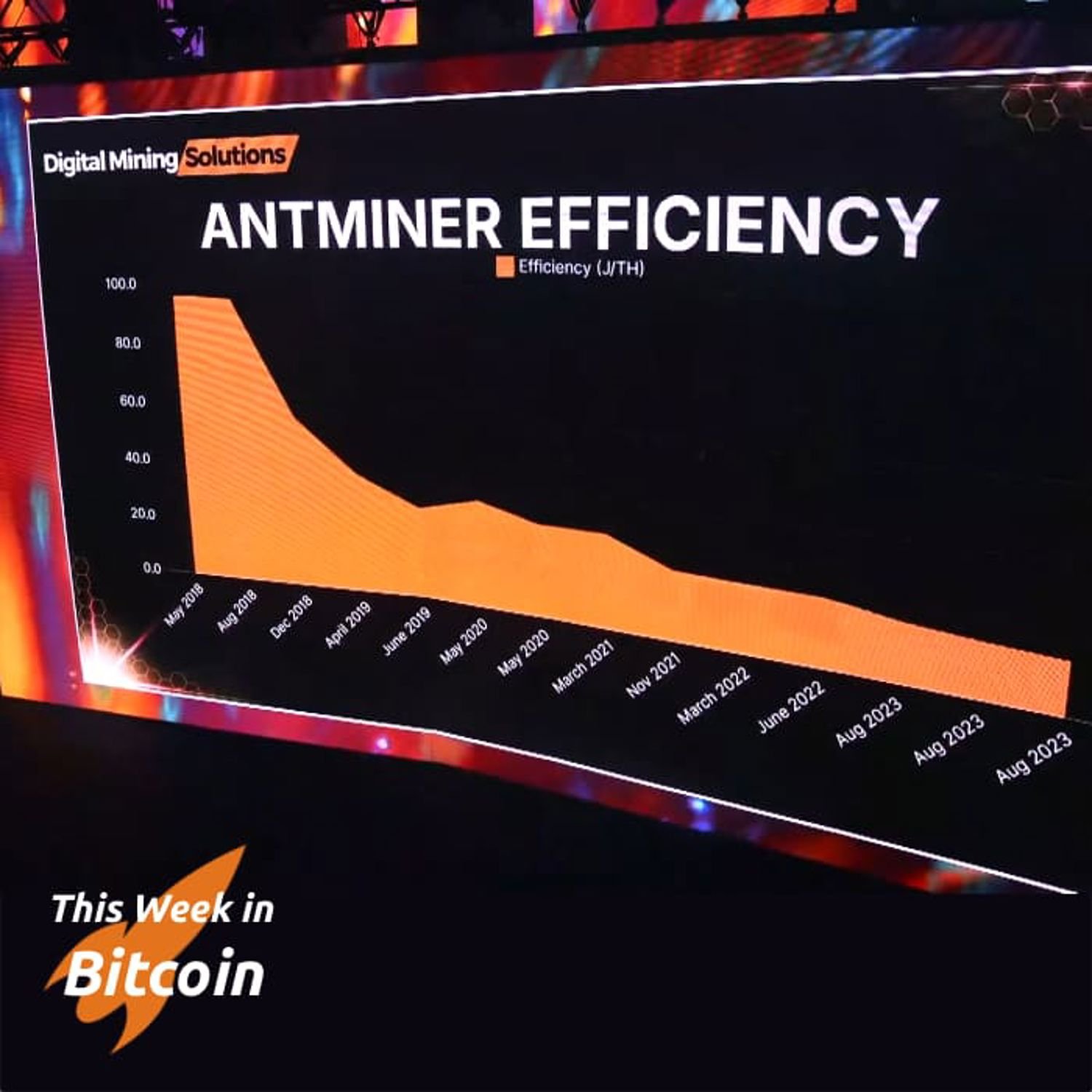

And they bring all that expertise together and start making money from the AI industry. I'm not quite sure how I feel about that, though. I'd love to hear your thoughts if you want to boost in how you feel about the mining industry doing more and more AI stuff. Today, as I record, Accord. It's day one of Bitcoin Amsterdam 2024. And there's a talk there called Mining Economics and the Future Outlook for a Profitable Tomorrow, if you want to look this up. It's by Nico Smit, I believe. He's from Digital Mining Solutions. And he goes into some of the challenges miners face just from an industry standpoint, but also from hardware advancements.

So we know what the block subsidy is because Bitcoin is beautifully programmed, but we don't know what the price of Bitcoin will be tomorrow, in two weeks from now, in five years from now. And the same goes for transaction fees. The transaction fees have been spiking up and down for the last year and a half, and it's very unpredictable where the fees will be at. And the same goes for network hash rates. Will it continue to grow as it did for the last years, or will it flatten out, go even more parabolic, or even slow down? And what's even more challenging is that miners don't have influence on any of these factors.

So, there's very few industries, I think, in the world where the producers don't have any influence over their revenue. So, I always advise miners to focus on that, that they do have influence on. And those are three main factors, which is efficiency, cost, and diversifying revenue. So if we go into the first part, how to optimize your efficiency, we can do that on two levels. One is on the ASIC hardware level, and the other one is on the infrastructure level. Here you see a chart of end miners, which is a popular series of ASIC Bitcoin miners produced by Bitmain, which is the main manufacturer in the industry.

And what is shown here is the efficiency of these miners. And as you can see, the efficiency has been improved quite a bit over the last few years. The charges here is expressed in joules per terahertz, so the amount of power that's being used per unit of computing power. And over the years, it's becoming less and less power that's being used to obtain that same amount of computing power. So up on the screen is a pretty standard chart. It starts from years ago, and it just kind of slopes downward and really kind of slopes downward now, but has sort of leveled off. It's much, much, much more efficient.

It's amazing, really, the efficiency gains. but for the last couple of generations we don't seem to be getting large jumps in efficiency like we were and he gets into that five years ago we were at around 100 joules per terahertz and right now we're nearing that 15 joules per terahertz level but you can see also that this curve is flattening out and the reason for for a reduction in the speed of the efficiency increasement is because of the chip size. So the first miner that was launched by Bitmain, the Antminer S1, was produced with chips that had 55 nanometers, which is already very small.

But the latest models, they are produced with 3 nanometer chips. And the smaller these chips become, the more sensitive they become for failures. So in order to prevent that you have a high failure rate, there's a limit to the chip size reduction. So as the chips get smaller, the error rates go up, So the production volumes go down, the costs go up. So it's interesting, like there's this, I guess, this sweet spot where the chip is only so efficient, but the cost acquired and the production volumes high enough that you make money mining.

Like it's a it's a really tight line that they have to walk. And to me, it's just a little insight into just all of the stuff that these miners have to look at while having no real control or input over like how much money the network is making them overall. That is a little rare. At least the gold miners have figured that one out. All right, one last bit of news before we get into our updates and our boost and all of that. This is a story that I saw go by today that just sent chills down my Bitcoiner's spine. And to me, it is at least evidence that for the next five-year window or so and probably beyond, altcoins are never going away.

And I don't know how Bitcoiners are going to cope with this. Visa has introduced the Visa Tokenized Asset Platform, and they plan for a live pilot on Ethereum in 2025. So you're introducing the Visa Tokenized Asset Platform. Walk me through what VTAP will do. Yeah, so we're super excited about the announcement this week. So VTAP gives the ability for banks to issue and manage fiat-backed tokens. And so one of the things that we've seen is really the growth and excitement around stable coins, which are now at an all-time high, around $170 billion in circulation. Stable coins. I think stable coins and this ridiculous hype around real-world assets, I think that too is going to be on some sort of smart contract blockchain, Solana or Ethereum or something like that.

So I have a question for you. Please boost it and tell me. how are Bitcoiners going to come to terms with this? And don't you think this means that at least some of these altcoin smart contract platform type technology things are going to be around for a long time? I mean, doesn't this sort of just lock it in when they start building tokenized trading platforms and whatnot? Wall Street degens might be the worst kind of degens. All right, coming up, your boost, some project updates, a final clip of the week. I really want you to catch and more. Music.

Shout out to those of you using my affiliate link in the show notes when you buy sats with River. I think it's a great place to DCA or do one time buys. You can withdraw on lightning to maintain your privacy. They let you check that they actually have the Bitcoin in custody that they say they have. They have proof of reserves and they got a slick interface and a great mobile app, too. And I have a link in the notes if you click that We both killed something just a nice way to support the show if you're buying sets and if you're spending sets Do it with the Bitcoin company comm use my promo code Jupiter That's Jupiter like the planet and you'll get some extra sats I get some extra sets another nice way to support the show you can instantly convert sats on lightning into, hundreds of different gift cards, on the BitcoinCompany.com's website. Use the promo code JUPITER.

Just one of the ways you can support the show besides boosting. Speaking of which, let's get to that. And we have a bunch of great boosts this week. Thank you, everybody who participates in the boosts. This is my favorite segment because this is all the stuff I didn't plan on talking about right here. So it's all organic. And our baller booster this week is Mr. Adam Curry, the podfather with 60,000 sets. Thanks for being our report in the storm, he writes. My wife, Tina, the keeper, just turned 62. Oh, happy birthday to Tina. And she opted for an early withdrawal from her Social Security and will be stacking every dollar of that into Bitcoin every single month.

That's really interesting. I was specifically asking about what people are doing for retirement. I think this is a good time to be doing that, especially at 62. She's still got years. She can do that. So she'll be able to appreciate some of those gains over, you know, four or five period. Fascinating. That's, you know, I think something we'll see. But I think that's going to be a theme in the boost this week. Thank you, Podfather. Appreciate that. Also, today's prep music was brought to you by the Booster Grand Ball. Bite Bandit comes in with 51,337 sats. I hoard that which your kind covet. That's not bad at all.

Sometimes my genius is, it's almost frightening. Chris, your timing was hilarious. Despite nearly constant reminders from my wife, I put off dealing with an old retirement account for two years. I finally got around to it last week. I decided to open a 401k and a Roth IRA accounts with Swan Bitcoin. I use Swan to DCA, so it was convenient and allowed me to put my money into Bitcoin without taking a big tax hit. I heard some of the drama, but I didn't think much of it until hearing this episode. I agree with your analysis, though. All these little turd nuggets are adding up, and it's starting to smell like a full-blown shitstorm.

As I type this boost, I'm looking at two checks made out to Ripple-owned crypto banks per Swan's instructions. I have to admit, I'm starting to have second thoughts. Ooh, that's rough. I have heard good things about Swan's IRA product, but that's rough. For some reason, Rivers KYC rejected me and wouldn't let me try again for 30 days. Oh! I ended up just going with Swan and never tried again. Again, I never had a KYC issue with any other company, but I'd really rather be with a River customer than a Swan customer right now. You know, I do hear from time to time. I mean, probably a couple times a month I hear from somebody that says, yeah, that's...

River just totally KYC kicked me in the butt and shut me down. I hate KYC because, you know, every now and then it bites you. You know, you can be going along, you can sign up for a couple different platforms and boom, one time. I hate it so much. Even sometimes, like, you know, you don't get a good picture of your ID or something. I don't know what it is. I just, I'm so sorry to hear that. And I appreciate the report. It's good to, you know, stay up to date on all that. I have no affiliation with River. So if the experience isn't good, I want to report on that as well.

User 20497192 comes in with 49,609 sats. You can set your profile username in Fountain if you like. Chris, thanks to you, I got Albie Hub up and running. And in other news, I'm switching my mining pool over to Ocean. Wow, those are both great updates. Congrats on the Albie Hub too. For some reason, I can't move sats over from Strike to my Albie wallet yet, but will persist until I find a way. Thanks for another stellar show. The Secret Thousand Oaks Bitcoin Meetup Sends Cryptic Greetings. Hello out there. Hello out there. You're doing a good job. So with a little bit more information, I might be able to give you a couple tidbits of advice, but it sounds like potentially it could just be a channel issue.

I'm not sure, but it could just be a channel issue. Maybe you don't have the right inbound channel, one that Strike can communicate with. Like you can have a perfectly fine channel with millions of sats ready for inbound, but if the sender can't find a route to that channel, you can still have it fail. So you may try opening up an inbound channel with somebody else. Just make sure it has enough stats too. That's sometimes where it's just, if the fees are low, it might just be easier to do an on-chain. Sometimes it is, although it doesn't have the privacy benefits.

Block 7 comes in with 20,000 stats. Coming in hot with the boost. Yes, add audio stats to the pot. Okay, there's a plus one. I'm going to write that down. Add the stats, but extend the total length of the show to accommodate the stats. Don't shorten my opportunity to stream you extra sats. I never thought of that. But you're right. I hadn't thought about cutting content, but I won't. I won't cut content to add that if I do it. Adversary17 comes in with 8,192 sats. This is the way. I says Bitcoin's definitely part of my retirement plan. I'm actually hoping for a huge dip for Christmas. Would love some cheap sats since I missed the 16K dip in 2022.

I've been wishing I started stacking earlier. There's no better time than now. 17. He goes on to say, it wasn't until 2023 that I really started understanding Bitcoin thanks to this and other podcasts. One about lawnmowers, I think, or something like that. The Bitcoin dad. Yeah, I understand. You know, but you start stacking just when you can, as soon as you can. And you just do a little bit at a time and don't think about it. Put it on autopilot and let her be for a while. But you're right. Right. A dip at Christmas would be kind of nice. It's weird. It's weird. You couldn't as a Bitcoiner, you can enjoy the rips and the dips if you really get into it, which I do.

Orange Bill lawyer's back with a Rodex. Absolutely planning Bitcoin in my retirement. The company allows me to manage a self-brokered 401k account. So I invest in BlackRock's ETF. I know it's not my keys. It's not really my coins, but with no other options, I'm at least getting price exposure. Totally. Yeah, I think that's a great example of where the ETF product makes sense. Additionally, you're going to find, I believe, I'm totally making this up just in my opinion, but I think you're going to find financial products will be made available to the ETFs before they're made available to people with self-custody coins.

There'll be some, but like, you know. Quick little collateral-backed loans, options, things like that. Those are going to come to the ETFs. And I don't know how it works if it's through a 401k, but it does seem like there's other specific market product fits where the ETFs make sense, and then there's ones where it doesn't. Orange Pill, I think that's one of them. Thank you for sharing. Monty33 comes in. Oh, it's an adorable row of ducks. Thanks for hitting the noob questions. I've got a few more that I'll drop into Matrix. Oh, okay, Monty. I may have missed them. I have not been in Matrix a lot because I've been out in the woods and whatnot, but I'll keep an eye out for it.

Fractal comes in with 5,000 sats. You supposed. I completely forgot about this newbie explanation video until the question was brought up on the show. Here's what you need to search for. Bitcoin actually explained by Luke Smith. He does talk about ETH and others as a comparison at the end, but whatever. Okay. Okay. I have not seen this one yet. Bitcoin actively explained, but there you go. There's this, we were hoping we would get one and we got one. One dull geek comes in with 4,444 sats. Affleck! If 2,222 sats is a row of ducks, then I think this is an all-wheel drive 4x4. I like that, but it's an Affleck duck.

You know, it's a big, big old duck. Affleck! But I also like the 4x4 boost, so you can persuade me if you keep it up. For starters, I like the idea of you tagging podcasts with the block height. Maybe also include the last four digits of the block hash as a way of timestamping your episode to the time chain. Honestly, though, I don't know what tangible benefit it provides other than just being kind of cool. Is Bitcoin part of your retirement plan? Of course, he says. Saving money is part of my retirement plan. Why wouldn't that include undebasable money? Yeah. Bitcoin is my savings. Yeah. I think, you know, to talk about my retirement plan a little bit, I just stack into Bitcoin as hard as I can.

And when the wife and I have a little extra cash, we go into Bitcoin. But also, you know, one of the things I'm experimenting in the last few months is optimizing anything that generates SATs. So for an example, I've been looking into a fold account to pay bills because they have a SATs back program. Things like that, just anything we can do to generate sat yield, even small amounts that we can stack over time. I experimented with a Gemini credit card for a while. And the Gemini credit card lets you get all kinds of weird crypto as rewards, but one of them, it lets you get Bitcoin. It's a good one.

And the Bitcoin rewards are up something ridiculous, like almost $400 or $500 in value, just rewards from a credit card purchases that I had to make anyways. So any way I can stack sets, if it's through a DCA, if it's that, I will. And I look at that, I do look at that as a savings account. That's the real savings account. You need to have some fiat on hand for when things come up. But I would be so nervous to store tens and tens and tens of thousands of dollars in fiat. And I sleep like a baby at night doing the same in Bitcoin. So I hope it's part of my retirement plan. We'll see.

Price actually has to go up for that to happen. Come on, October. What happened? Moonanite's here with 2,500 sats. Make it so. Just as you were reading off the boost from this episode talking about fountains crashing us, mine crashed. It seems to only happen if I listen while I'm charging my phone. I wonder what could be going on there. You know, Moonanite, the first thing that came to my mind was maybe thermal management. You know, Android will kill a process that's running the CPU if you're hot and if you're charging. I don't know. So you'd have to be like several scenarios. You're like on the edge of signal.

Fountain's using a lot of CPU for some reason, which is not normal, but for some reason. And you're charging, and then there's like a thermal, you know, process killing. I wonder. I often think, too, it's memory related. I think that's the other reason is, you know, there's like basically an out-of-memory killer on Android. And I think those are some of the leading causes, but I don't know what, you know, is the, I guess, leading symptoms. I don't know what the actual core causes. Let me know if you figure it out. Coach Rick's in here with 2,024 sats. Hey, Coach Rick. Coming in hot with the boos. I vote no to listing out the price stats during the show.

But I'm also not brave enough to put more than one small percentage of my retirement into sats. Maybe that's why you don't want to hear the number, Coach. Got to get conviction. All right. Thank you. So scratching one off for stats. We had two, and now we have, okay, scratching that one off. User 47 comes in with 5,000 stats. That's a Jar Jar boost. You supposed. He noted my buy the invasion. Yeah, I just thought that was such a ridiculous title. I feel like if you read it, you're like, what is this guy? He's so cynical. But then you realize I'm actually making fun of some of the analysts that just toss that kind of stuff around.

I'm glad you got the joke. Ace Ackerman comes in with a row of ducks. I vote yes on a brief report for Bitcoin stats during the show. Maybe rotate on which ones. Maybe one or two per episode. Bitcoin definitely plays a role in my retirement strategy and estate planning. I got to set those kids up for success. All right. So that's three for yes. One for no. I agree. I'm I'm also helping my kids stack now. And ideally, I would love the vast majority of my stash to not get spent. And I would love it to go to my kids as well. I'm hoping they can use it. So part of me, you know, part of me really likes what Bitcoin makes me do. Bitcoin forces me to think long term.

I even in the last week, I've thought several times if I want to see Bitcoin at a million dollars, I got to stop eating crap food. You know, like I get really busy with work and the first thing that slips is food preparation, So then I just start eating, you know crap just to get by through the day. That's not good for you Plus sitting around all day. I'm not gonna make it to 1 million Bitcoin You know and then also if I want to see my you know If I want to see my kids be like I got a I got to be able to like live So it makes you like happy like being a parent. It kind of makes you think long term.

I like that about Bitcoin a hybrid sarcasm He's coming in with 10,000 sats. This is the way Plus one for the newbie video. I would love to see one too. My spending sats are held like this. Streaming sats go to Albi because I listen to Cast-O-Matic and boosting sats are in Fountain. Whoa, streaming sats in Albi and boosting sats in Fountain. Still working on my holding workflow. For now I'm stacking them in cash.app and Strike. Yeah, we should get, you should, those are some of the lower risk ways, but I still think you should get them out of there. You know, I don't think there's an emergency or a risk.

Traditionally, when the market does start to move quickly, those platforms can sometimes every now and then have issues. I don't have any key examples, nothing like Coinbase. But just something for you to keep in mind is if things really rip or whatever, sometimes when you want to get access to that stuff, it's a little delayed by those hosted platforms. It's just another reason to get it off there. When the market's doing crazy stuff, you don't worry because you've got your coins in cold storage. But I do like your approach there with having Albi and Fountain. A couple of really great ways to interact with the Lightning Network.

Fountain's really doing it on easy mode, too. Paranoid Coder comes in with 2,000 stats. I'd love to hear some Bitcoin stats each episode. Okay, another one. That's four. Also, yes, I'm stacking for retirement each paycheck I set asides. I have a little bit of money that goes into my brokerage, my IRA, and Bitcoin. I'm pretty sure I'll regret not putting everything into Bitcoin in the future, but I currently sleep soundly at night. Well, you've got to live with what we know today. I sometimes really kick my butt about spending lots of Bitcoin back in the day, you know, but we didn't know where it was going and we believed in spending to accelerate adoption and not in saving as much and kick my butt for that.

But I also, you know, I had a good time along the way. I have equipment I still use today. So kind of it's I think it's a balance of living for today and living for the future. Minticola comes in with a Rolodex. As far as Bitcoin stats, I'd be interested to hear the high and low between each episode. Hmm. I do plan to go back and review what you all suggest after the episode, too. So that's another one for stats. Maybe I'll maybe I could like incorporate at the end as I'm signing off or something for the folks that don't want it. I like that idea, man. Thank you. Appreciate the boost, too.

Vault Bites in with 4,444 sats, which we've established. That's an Aflac duck. Aflac! It's a duck army fighting FUD. It's icy. Yeah. Yeah. See, that's exactly. It was two different boosts. Both were rows of ducks, which make one really big duck. Right? I don't know. Gene Bean also. Also, comes in with a row of ducks. The stats per USD is interesting, especially if you include trends. Overall, I say include the stats. Regarding the retirement, I suck at traditional savings, and I'm starting to look at Bitcoin as a better way to accomplish that actual goal long term. You know what, Gene? I think you are not going to be the only one in the next few years, so you might be still ahead.

So you like stats per dollar, huh? Yeah, I like that one too. The high and the low would be interesting. I wonder if there's anything out there that tells me that. I'd prefer not to be creating a spreadsheet. If anybody knows of a tool. I know like Clark Moody's dashboard and stuff like that. But something that would tell you the high and low between two day points. That's an interesting idea. All right. So that was a total of one definitely against. Well, not definitely, but kind of against. And one, two, three, four, five that were pro stats.

So I'm going to give that some thought. I'll try to do it in a way that isn't obnoxious or a cliche. And try to do it in a way that's actually bringing value to the show. So I may think on it a bit. I may have it next week. I may not. I don't know. I don't know. But I do know that I appreciate everybody who participates in the value for value model and sends a boost in. We had 42 different individuals sit back and stream those sats as they listen. So we stacked 38,967 sats that way. Thank you, all of you sat streamers. When you combine that with the folks who boosted in a message.

We stacked this week a grand total of 278,230 sets. Thank you, everyone, for supporting the show. It is a Value for Value podcast. And I love getting those messages. I think it's really helped define the direction of the show in certain ways and get a real good feel of what you are interested in. And I was just thinking earlier today, like, really confirms what a smart audience you are, too. which I'm pretty proud to have on board. And I just love interacting with you. If you'd like to send a boost in, you just need to grab some sats, which if you don't have already, yeah, you got other problems, and then get a new podcast app, something like Fountain or Castomatic or so many other great ones like Podcast Guru and more.

They're listed at podcastapps.com. And there's so many from open source to like totally cool new ideas. Fountain's great for Nostra integration because it can be a super quick way to get started in Nostra. Then you also get the additional features of the podcast, transcripts, cloud chapters, early release notification, live stream if it ever happens, and, of course, the boosting. So I think I made my point. There's a lot of reasons to get a new podcast app. So go do it. Music. I knew this was going to be a big one with the breakdown of the docudrama. But I do have a couple of quick project updates, like I mentioned.

It's day one, as I record, of Bitcoin Amsterdam 2024, and I'm keeping an eye on things over there. Just to kind of get a sense of what's going on, if any news breaks, I'll cover it. Also, one of my favorite projects for Bitcoin privacy just had an update. It's Jam. Jam 0.3.0, which is a web interface for JoinMarket. And now they've added an easy way to quickly freeze and unfreeze UTXOs, review eligible and or selected UTXOs before sending them and fixes for just a couple of other issues. But Jam is it's like it's like the new way to engage in Bitcoin privacy and something that's it's a really elegant system. And the UI makes it very understandable.

So that is the Jam Web Interface app. And shout out to No BS Bitcoin. That's what happens when the show goes on for too long. Shout out to NoBSBitcoin for surfacing that one to me. Also, I noticed this week that Robinhood has signed a deal with BitKey. BitKey is that hardware wallet that Jack Dorsey's behind that pairs with a mobile app and their cloud service for recovery. And now the Cash app, Coinbase, and Robinhood allow you to purchase Bitcoin and transfer it directly to your cold storage without having to leave the BitKey interface. I, if I had the time, I'd love to pick one of these bit keys up just to test it.

I don't really like having my Bitcoin stash tied to a mobile device, A, but maybe a graphene device I had full control over, I'd consider. And B, I don't like it being tied to a company, but I think there's ways around that. And the advantage to tie to a company is really when it comes into recovery, they can help you do recovery steps. But I've broken down some of their tech before on the show. It's pretty good. It's pretty good. but it's not just not quite the offline like totally untouchable like a cold card or something else is but this ability to buy bitcoin and store it directly to your cold storage it's a nice feature i'd love to see more people do that live wallet version 0.9.0 is now available one of the big things is they recently added support for linux desktops now this is a cool project because it's a tool that helps you estimate the effect of bitcoin transaction fees on individual utxos.

Or if you have a transaction with a bunch of UTXOs in there. And so it gives you an idea of what you're looking at cost-wise and might help you estimate how much you should accumulate when you're DCA-ing before you store it in cold storage. And so LiveWallet version 0.9.0 is out with recent support for the Linux desktop, which is freaking great to see. I think they're packaging it for RPM distributions, but I imagine you can probably get it packaged up for just about anything and it will be pretty soon okay so our last clip of the week is strikes jack mallers and he always i think has the most poignant points about leaving satoshi alone and he perfectly echoes my sentiment and this is how i wanted to wrap up my thoughts on the drama documentary that we covered earlier today this is jack and he makes the case for just leaving satoshi alone.

Satoshi Nakamoto asked for one thing from all of us, and that was to be left anonymous. That's it. This person did not ask for monetary compensation. They didn't want a Nobel Peace Prize. They didn't want to be listed on the Forbes list. They reiterated over and over and over again, they just want it to be left alone. And so for all of us that have benefited tremendously from this invention, or those that maybe haven't had as much an interest as those that are on this podcast or listen to this podcast, still just the decency of being a human to honor and acknowledge that one request and just leave the person alone.

So out of respect for the person that could have changed my life the most of anyone ever, I will not entertain doxing them and violating their one request, period. It does not get any more fiat than a journalistic publication in the mainstream trying to dox and harass Satoshi Nakamoto for self-interested benefits. It is anti-Bitcoin. I will not stand for it. I will protect and honor Satoshi Nakamoto's one request to me and all of us is to leave them alone and protect their identity. I don't care who they are, and I don't ever want to know who they are. Moreover than that, also, on a broader topic, I don't like to think of Bitcoin as having an inventor or being... I think of... Listen, gold doesn't have an inventor.

Corn doesn't have an inventor. Aluminum does not have an inventor. Commodities, these things are born out of mother nature. In the same way that Albert Einstein, I don't think Albert Einstein found the equation, right? Would you guys agree with that? Albert Einstein maybe found E equals MC squared in the same way that I think Satoshi found Bitcoin. So I don't think that it's this authoritarian CEO, president-like leader and inventor of a thing like a cult. Satoshi Nakamoto took pre-existing cypherpunk technology a movement and a compilation of things and found Bitcoin Michael Saylor says it was the fire and cyberspace that finally sparked people had been trying to rub wood together for decades and this one finally lit and so I don't even think.

And identifying the person that found it, who cares? Because it's not as if it's an inventor that has any outsized control or gives direction over the project anyway. Albert Einstein found E equals MC squared. It was out there. It was in the mathematical universe. He found it. And same thing with Satoshi. Bitcoin was out there. He found it. He found proof of work plus the difficulty adjustment. He found that. I agree. And I was starting to make this point earlier in the show. Bitcoin is built on top of a long, long 40-year history of technological discoveries and work to be made possible.

And he brought together a few unique ideas that were brilliant and extremely insightful. But he was standing on the shoulders of giants. It's not an impossible task. And I have a beautiful infograph that really goes through the 40 years of discoveries that led to Bitcoin. I actually, I sneaked it into last week's episode show notes too, but I'll put it in the show notes again this week because I think it's really great. So go find that. Okay, that's a long one. I apologize. I do try to keep these tighter, but there's just, there's a lot going on, you guys.

There's a lot going on right now. So let's wind down with a value for value track. If you boost during the song, 90% of your sats will go to the artist. This has been such a cool development in the music world. And this week, I'm leaving you with Unleash. And once again, it's by Tony Salamone. I guess this is goodbye. Music.

Music. Welcome to This Week in Bitcoin, episode 30. My name is Chris. Thank you for joining me. I might be a little salty this week, so I apologize ahead of time. I don't know. I just think I'd wager that Bitcoin is one of the most significant technology innovations of our lifetime and beyond our lifetimes. And the people, the artists, the communicators that could help spread the word to a new audience, to people that don't understand it, always seem to get lost on who is Satoshi Nakamoto. And that happened again this week. Money Electric, the Bitcoin mystery, created by Colin Hoback, which he's also known for his documentary on QAnon, which, by the way, we'll get into this, but it's ironic that the creator of a film going after conspiracy people and QAnon is now employing the same exact kind of conspiracy by reasoning and coincidence type thinking to make this connection to who he believes Satoshi Nakamoto is.

Now, I wish people would just stop asking this. I really do. I think we should just seriously let this be. It's quite literally better for everyone. But the media won't stop. And they just get almost feverish about it. And as soon as the news about this documentary came out, they went into overdrive speculating who it could be, including speculating about the wrong people entirely that wasn't the conclusion of the movie. Today, everyone is talking about a new HBO documentary called Money Electric, the Bitcoin mystery. It launches today and it claims to unveil the identity of Satoshi Nakamoto.

Now, the documentary is directed by filmmaker Colin Hoback, who made a name for himself, unmasking the leader of the QAnon conspiracy theory. And while past efforts by investigative journalists have failed to find the true identity of Satoshi, the Internet is going wild. Hoback's cracked it, though. Nobody else has figured it out. Hoback has cracked it. And we'll get into his evidence. I've watched it, so you don't have to. It feels like it's six hours long. It's a topic I am extremely interested in, and it felt tedious to me. So I watched it. I'll pull a few clips that I think you need to know just so that way you know the context of it and the conclusions, and we can talk about it.

But I want to go back to my original point before we get there. This has led for at least a week now of speculation of who the big reveal might be and then doing these exposés on all of these individuals who didn't ask for the attention in the first place. Everyone is on the edge of their seats waiting to see who's going to be named as the creator of Bitcoin. You've probably heard a ton of theories of who Satoshi Nakamoto could be. Some saying it could be the CIA, while others say Hal Finney, Nick Szabo, even Elon Musk has made the list. But today on this show, I want to explore another name, Len Sassaman.

So who is he and why are so many convinced that he could be the mastermind behind Bitcoin? Let's get into it. Let's not, because he wasn't the conclusion of the documentary, if you can call it that. But it didn't lead to it just I mean, it led to everybody speculating for a week long. So I have really mixed feelings on this. Every now and then there's a couple of good bits of info that I wouldn't mind friends and family to understand. But there's also just lots of like low key accusations and implications that are kind of really in there just to make the document, the documentary, whatever the movie, the series to feel more compelling.

But it's people's lives that are kind of getting screwed with here. So, I mean, if I wasn't watching it for the pod, I probably would have just fast forwarded through some of this. The creator Hoback got into Bitcoin at least a little bit in 2017, played around with mining, but never really seemed to have much success, at least from his claims. And, you know, this is it's it comes on the HBO network. So, of course, starts with the big HBO stinger, you know, get ready, get ready. And kind of cleverly so, at the very beginning of the series, they try to hook you with the haters.

So the documentary just brings receipt after receipt after receipt of folks that said Bitcoin was dead or a scam. This is the opening right here. So every day, you know, you have nonstop Bitcoin. Who cares about Bitcoin? Jamie Dimon. 2010. I could care less what Bitcoin trades for, how it trades, why it trades, who trades it. If you're stupid enough to buy it, you'll pay the price for it one day. 2011. Forbes says it's the end of Bitcoin. Bitcoin seems like a scam. Magical internet money. It has no intrinsic value. 2013. Bitcoin is worthless. What makes it valuable? Totally BS. Bitcoin's a dead end.

It's a combination of a bubble, a pond scheme, and an economic disaster. Whatever it's doing, it's not money. Whatever Bitcoin is. Money. Bitcoin is simply going to implode before you know it. Today we're having a funeral for Bitcoin. 2021. Despite all the doomsday prophecies, just 15 years after launch, Bitcoin had become the 10th most valuable asset in the world, outperforming Wall Street by a massive margin. One of the biggest unanswered questions surrounding Bitcoin is who invented it? When you ask about the creator, Who created this? We have no idea. There's these things called nerds.